Can Anyone Catch AWS Now?

Views, News & more

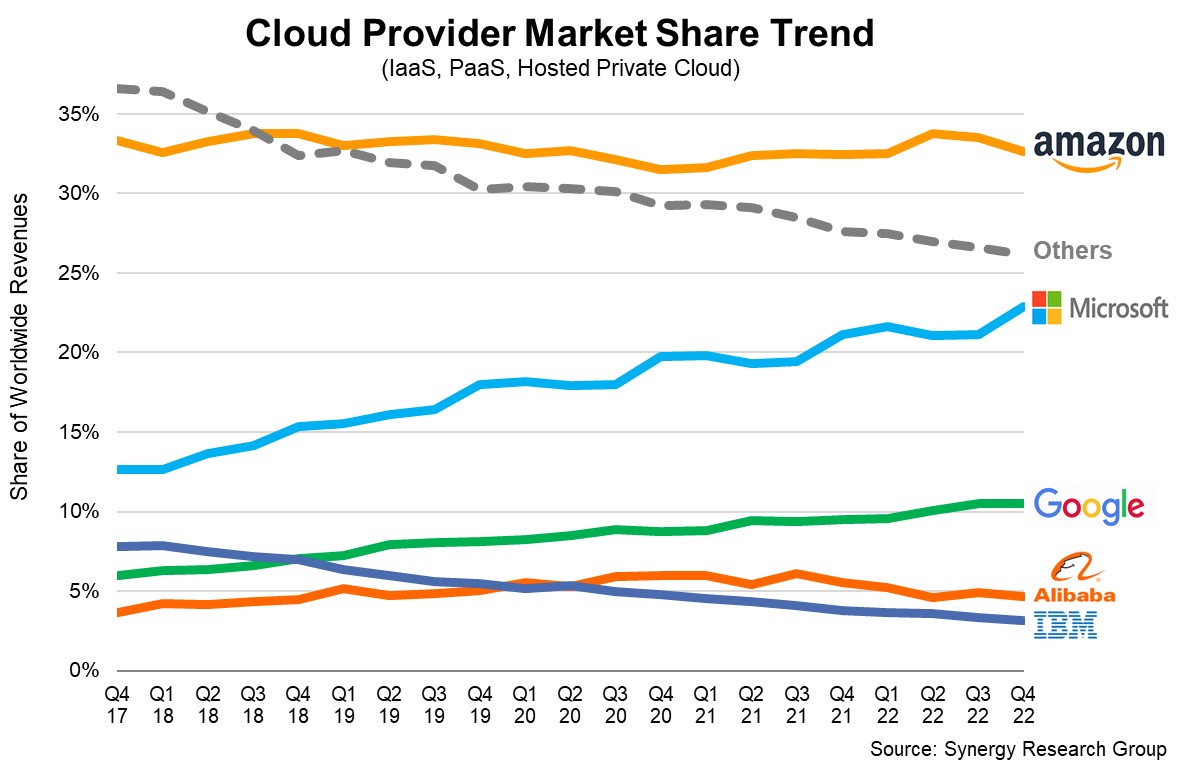

Amazon, Azure and Google capture 65% of cloud infrastructure spending, with Amazon receiving almost one pound in two spent with the big three cloud providers.

Amazon has 32% of the market, Microsoft has 23% and Google has got 10%, according to Synergy Group Research.

It won't surprise you that Amazon is in the lead. It may surprise you that this lead keeps falling.

Why is AWS Losing Its Lead?

Microsoft and Google have been growing their market share, while AWS has maintained its existing share.

Google has funnelled billions from its lucrative search engine to its cloud division. This has allowed Google to compete with AWS in the hyperscale end of the market, even though it doesn't yet have the same economies of scale.

Google has faced an uphill struggle to grow its market share, not that you'd know it from the graph above. Being late to the party, Google's initial strategy was to focus on a niche - serving developers of cloud-native apps, especially those working at startups. Broadening Google Cloud's appeal from developers to the enterprise IT market has been challenging as it requires a more consultative approach and selling through partners. Still, with dogged persistence and a few billion dollars, it's amazing what can be accomplished.

Microsoft has also been gaining market share, thanks to a unique asset Amazon and Google can't match - a network of 400,000 channel partners. These partners are now being encouraged to help their customers take advantage of Microsoft's cloud offerings, including Azure and Microsoft's partially-hosted version of Office, Microsoft 365.

The remainder of the cloud hosting market is very fragmented. Alibaba has around 4% market share. IBM and Salesforce each have 3%. Oracle and Tencent each have 2%. And Baidu, China Telecom, China Unicom, Huawei, Fujitsu, NTT, Snowflake, SAP and Rackspace each have around 1%.

AWS v Azure v Google - A Battle That's Good For You

UK regulator Ofcom has investigated the UK cloud market and has said it has "significant concerns." Ofcom found certain practices and features of the public cloud market "could limit competition," so intends to ask the Competition and Markets Authority to "further examine the nature and extent of barriers and consider if there are interventions that could improve how the market works."

Such interventions are likely to be minor - focused on niche points such as data egress charges and software licencing restrictions/discounts.

The real protection against misuse of market power will come from competition. Azure gaining on AWS, and Google gaining on AWS and Azure will do more to ensure value-for-money than likely regulatory interventions.

The end result will be that big cloud providers' margin expansion stop in the right place - with the three biggest clouds routinely profitable but unable to abuse their market positions.

This competition is good for your pocket, even if you don't use AWS, Azure or Google directly. You pay for these services indirectly through your taxes (large public sector organisations often spend significant amounts on cloud hosting). You also pay for these cloud services indirectly by paying suppliers, such as SaaS providers, that rely on these big clouds to deliver their services.

A Growing Pie

It's easy to look at the market share of the three largest clouds and assume that smaller clouds are toast. Over the past 5 years, other clouds have lost around 10% of market share.

That overlooks one important factor: spending on cloud hosting has grown rapidly during this period. That substantial decline in market share doesn't typically translate into lost revenues, just a slower rate of revenue growth.

Giant Organisations' Preference for Giant Clouds Creates a Misleading Impression

Giant multinationals and public sector bodies skew the aggregate market share figures, making it appear as though the big cloud providers are the only game in town.

While this may be true for giant customers that have atypically complex or large requirements, it's not true for most organisations, who frankly don't need that complexity.

Most organisations don't need to host an app in 10 countries, just one.

Limitless scalability isn't of use to them, as they couldn't afford to pay 10 or 100 times their current hosting bill.

They don't have the time or money to rebuild their apps from scratch to be cloud-native.

They need advice on moving to the cloud. A self-service portal and online documentation aren't enough.

So there will continue to be a lot of demand for 'other clouds.'

Competition is Alive and Well in the UK Hosting Mid-Market

You have plenty of choice when it comes to hosting your server-based applications. The big cloud providers remain a valid option. However, smaller hosting firms may offer something closer to what you need.

These smaller providers are large enough to build and support enterprise-grade hosting environments but small enough to offer a personal service markedly different to the cookie-cutter services offered by the biggest cloud providers.

How Smaller Providers Are Differentiating Themselves From AWS and Other Big Clouds

Support - Some hosting providers offer 24/7 phone support as standard. This contrasts with the big clouds that require you to pay extra to receive such support.

Expert Advice - Smaller cloud providers may be able to offer personal guidance to organisations looking to shift to the cloud. The big clouds tend not to go there. If you need that sort of assistance, they expect you to write a large cheque to their consulting partners. That's fine if you're an investment bank or a large multinational, but not so great if you're a typical organisation. So this is one area where smaller cloud providers can provide a lot of relative value.

More Than Hosting - Many smaller cloud hosting providers are able to offer hosting as part of a wider package. For example, they may be able to offer connectivity to corporate offices, private connectivity to the biggest clouds and colocation space. The big cloud providers tend not to want to get involved in those areas. They tend not to allow you to colocate existing servers or firewalls in their data centres and typically won't even tell you where precisely those data centres are.

Extra Resilience - Some smaller cloud providers offer resilient hosting, where your workloads are hosted on a server cluster hosted across multiple data centres. With the big clouds, you often have to do complicated things to arrange for your VMs to failover from one hyperscale data centre to another.

How hSo Can Help

If you've got server-based workloads, hSo's resilient cloud hosting could be just what you need. It's built on trusted VMware Cloud Director, comes with 24/7 phone and email support, and offers predictable monthly bills.

If you'd still like to use the big clouds, hSo can help connect you to them - with private connections to AWS, Azure, Google Cloud, Salesforce and other major clouds. We can also help you setup or manage Azure and AWS environments.

hSo can help you back up server-based data to an offsite location, automatically.

And if you're concerned that recovery from backups might take too long, our Disaster Recovery as a Service can make sure you're ready to restore to cloud-based servers rapidly in the event of a disaster.

To find out more, call 020 7847 4510.

Get in touch

020 7847 4510

We may process your personal information in order to send you information you request, measure and improve our marketing campaigns, and further our legitimate interests. For further details, see our privacy policy.

Contact us

-

- Head Office:

- hSo, 50 Leman Street, London, E1 8HQ

- Switchboard:

- 020 7847 4500

- Support (24x7):

- 0333 200 3337

- support@hso.co.uk

- Marketing & Sales:

- 020 7847 4510

- info@hso.co.uk